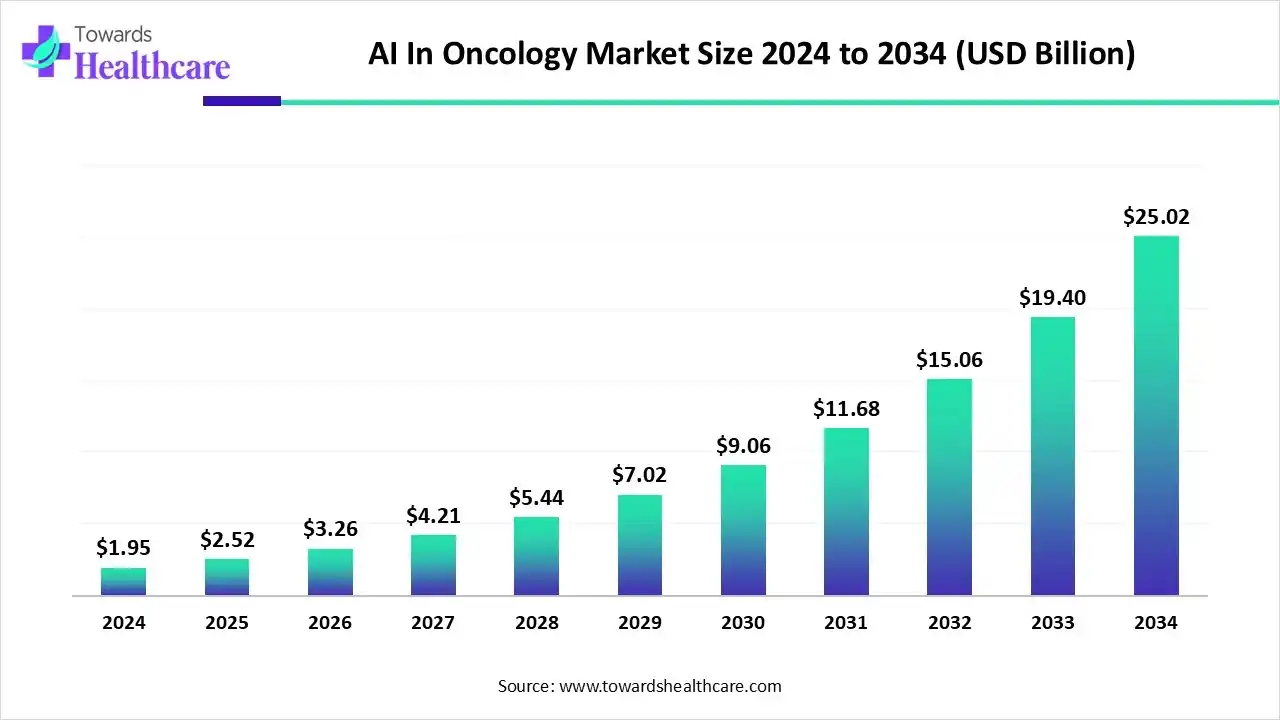

Ottawa, Nov. 21, 2025 (GLOBE NEWSWIRE) -- The global AI in oncology market size was valued at USD 1.95 billion in 2024 and is predicted to hit around USD 25.02 billion by 2034, rising at a 29.36% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The AI in oncology market is surging due to the growing global cancer burden combined with advances in artificial intelligence that enable earlier detection, more precise treatment planning, and cost-efficient care.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6328

Key Takeaways:

- AI in oncology industry poised to reach USD 1.95 billion by 2024.

- Forecasted to grow to USD 25.02 billion by 2034.

- Expected to maintain a CAGR of 29.36% from 2025 to 2034.

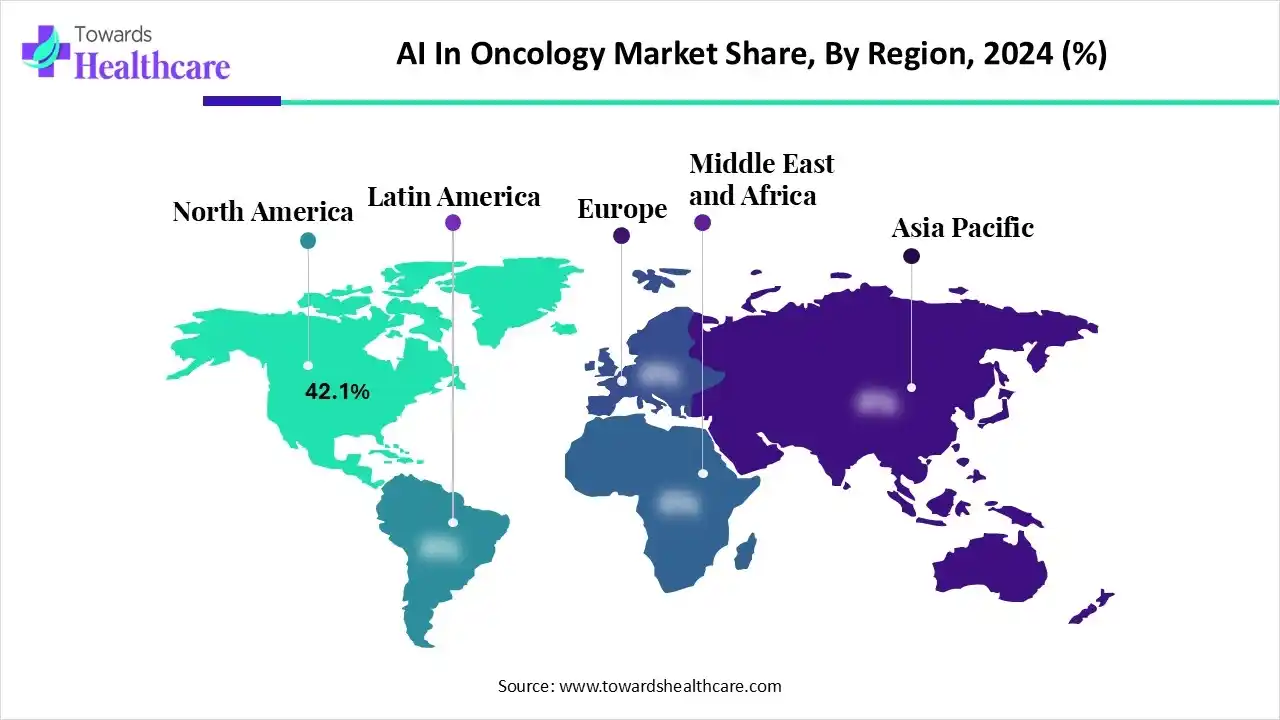

- By region, the North America segment was dominant in the AI in oncology market in 2024, with approximately 42.1% share.

- By region, the Asia Pacific segment is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By component, the software solutions segment was dominant in 2024, with approximately 64.34% share.

- By component, the services segment is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By applications, the breast cancer segment was dominant in 2024, with approximately 28.23% share.

- By applications, the lung cancer segment is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By end user, the hospitals segment was dominant in the AI in oncology market in 2024, with approximately 45% share.

- By end user, the pharmaceutical companies segment is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By deployment mode, the cloud-based segment was dominant in 2024, with approximately 55% share, and is expected to grow at the fastest CAGR during the forecast period.

- By deployment mode, the on-premises segment is expected to grow significantly over the forecast period, 2025 to 2034.

Market Overview:

How is AI Reshaping Cancer Care and Why are Healthcare Platforms Rapidly Applying it?

The global market for AI in oncology is truly transformative as healthcare providers incorporate intelligent technologies that aid in the detection of cancer at early stages, enhance diagnostic processes, and improve treatment specificity. As the clinical burden increases and providers focus on improved personalized medicine processes, advanced AI is being deployed in imaging, pathology, and genomic platforms.

These technologies allow clinicians to determine subtle patterns that may not be recognizable to humans and facilitate clinical decision-making across the cancer care continuum in a more timely and precise manner. Adoption is ultimately driven by value-based healthcare, digital health investments, and the growing ecosystem of new AI-enabled platforms being established across hospitals, cancer centers, and life-science research environments.

Executive Summary Table

| Table | Scope | |

| Market Size in 2025 | USD 2.52 Billion | |

| Projected Market Size in 2034 | USD 25.02 Billion | |

| CAGR (2025 - 2034) | 29.36 | % |

| Leading Region | North America by 42.1% | |

| Market Segmentation | By Component, By Application, By End-User, By Deployment Mode, By Region | |

| Top Key Players | Siemens Healthineers, GE Healthcare, Medtronic, IBM Watson Health, NVIDIA Corporation, Philips Healthcare, Flatiron Health, PathAI, Azra AI, ConcertAI, Digital Diagnostics, Median Technologies, Radformation / Limbus AI, DeepMind Health, Intel Corporation, Canon Medical Systems, Oncora Medical, Paige AI, Imagia Cybernetics | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

What are the major trends impacting the market for AI in oncology?

- Increase in cancer cases & demand for early identification: With the incidence of cancer increasing worldwide, health systems are significantly increasing the use of AI-powered diagnostic tools to locate tumors earlier with the goal of improving patient outcomes.

- Innovation in AI & machine learning: Additionally, with new, more advanced AI algorithms such as deep learning and multi-omics integration, the accuracy and efficiency of cancer diagnosis, treatment planning, and drug discovery are all improving.

- Increase in financing and funding of AI in oncology: Many venture capitalists, private investors, and public funding are being utilized by companies merging clinical data with AI models, which is supporting innovation and the faster commercialization of those models.

- Regulatory support & increasing clearance of AI-based tools: Regulatory bodies are certainly becoming more proactive about AI powered medical devices. The FDA clearing AI-enabled oncology solutions has the potential to create a widespread acceptance of AI tools in clinical practice.

- The shift to value-based care and precision medicine: AI can produce precision medicine treatment strategies using patient-specific data (genomic, clinical, imaging) and the emerging value-based care paradigm where data and better outcomes justify the investment.

Key Drifts:

What are the emerging trends within the AI in the oncology market?

One of the most significant key trends in this market is the shift from fixed hardware purchases to a more flexible, scalable software-as-a-service (SaaS) model, more and more, healthcare providers are preferring subscription-based AI platforms that embed into workflows, and that do not require the upfront fixed infrastructure costs. Another key trend is multi-modal AI that utilizes imaging, genomic, and clinical data, allowing for more accurate and personalized predictions regarding cancer progression, treatment toxicity, and patient response.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

One of the largest challenges to overcome in the AI oncology market is the need for rigorous clinical evidence and regulatory validation. Many providers are reluctant to adopt and use tools for which there are no robust, peer-reviewed outcomes evidence demonstrating that it improves clinical outcomes and reduces costs consistently. Similarly, the reimbursement models for AI use with our current healthcare payment systems is complicated, and is inhibiting the scaling up of these technologies in the real-world.

Regional Analysis:

North America is the largest region with 41% contribution to the AI in oncology market size, attributed to a stronger healthcare infrastructure, greater access to public/private funding, and greater concentration of major key players of AI in oncology development. Supporting clinical research ecosystems along with regulatory frameworks are fully developed (i.e., FDA) to enable more rapid adoption of AI-based tools in the diagnostic and treatment planning process. Since most hospitals/cancer centers have and continue to embrace AI to promote workflow and patient outcomes, North America's dominance will continue due to its significant venture capital investment and partnerships formed between technology companies and oncology institutions.

Asia-Pacific is the fastest growing region, fueled by an increase in cancer incidence, increased healthcare spending, and a rise in the adoption of digital health infrastructure. While looking towards a more digital landscape, countries like China and India are investing heavily in AI-driven screening and precision medicine. Due to many hospitals upgrading/breaking ground as a part of their modernization plan, and cloud-based solutions, the implementation of AI at scale can happen more easily. Government-backed initiatives to encourage early cancer detection, and a push for AI use, provides additional fuel for growth. As a result of increased data sharing and healthcare digitization efforts, healthcare systems in Asia-Pacific are starting to integrate AI into their oncology pathways.

Segmental Insights:

By Component:

The software solutions segment represented the largest share of the AI in oncology market, as it continues to be the engine of automated diagnosis, treatment planning, and precision-focused decision support. Healthcare providers are heavily reliant on AI platforms that can process large image datasets, predict disease trajectories, along with supporting personalized treatment pathways. Demand for enhanced software solutions is compounded by the emergence of digital oncology ecosystems based on cloud, advanced analytics, and machine-learning models. AI-driven tools in radiology, pathology, and genomics are increasingly implemented into routine workflows, enabling clinicians to deliver more accurate and timely cancer care.

The services segment is predicted to grow with the fastest CAGR, as healthcare organizations continue to seek necessary specialized support for AI deployment, optimization, and ongoing maintenance purposes. Many hospitals, research institutes, and cancer centers work closely with service providers in seeking expert assistance to integrate AI into existing IT environments, adhere to regulatory standards, and train clinical teams in the use of novel digital tools. Service providers can also provide critical value by tailoring AI models to be interoperable with electronic health records and strengthening cybersecurity across digital oncology platforms. With the rapid evolution of AI technologies, upgrades and technical assistance must occur on a continuous basis to ensure ongoing performance.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By application

Breast cancer represented the largest proportion of AI-enabled oncology applications as clinicians increasingly rely on intelligent imaging and diagnostic platforms to more reliably detect early-stage lesions. Use of AI tools has enhanced mammography interpretation, facilitating the quicker identification of abnormalities that human analysis of traditional images might have missed. A growing global emphasis on preventive screening and expansion in digital pathology and risk-stratification models have extended AI's emerging use in breast cancer care. Meanwhile, hospitals and diagnostic centers have begun to incorporate predictive analytics into personalized treatment planning and monitoring therapeutic response.

Lung cancer is likely to be the fastest-growing area of application, as facilitating early detection continues to be one of the most challenging areas in respiratory oncology. AI-enabled imaging algorithms have illustrated incredible promise for detecting small nodules and high-risk patterns on CT scans, resulting in earlier and higher-quality diagnoses. Increased application of AI in population-based screening programs, and in monitoring of high-risk patients, expands adoption. Further, oncologists although still generally hesitant, are beginning to utilize machine-learning tools to predict tumor behavior, optimize selection of directed therapies, and assess response to immunotherapy.

By End User:

Hospitals continue to lead the way in AI adoption in oncology, given their position in the broader healthcare system with the core activities of diagnosing and treating cancer and supporting multidisciplinary cancer care. Hospitals are essentially using AI systems to improve diagnostic accuracy, reduce image acquisition and interpretation time, and enable faster clinical decision-making. Eventually, we will see AI systems integrated into radiology, pathology, and surgical oncology units to improve clinical efficiency by decreasing the time-to-diagnosis and increasing collaboration across specialties. Hospitals are also investing heavily in cloud-based solutions, predictive analytics, and AI-powered automated care-pathway solutions to drive improvements in patient outcomes.

Pharma is expected to see the fastest growth in AI adoption because drug developers integrate advanced algorithms into their oncology research and clinical trials. AI systems are innovating drug discovery by allowing streamlined identification of new therapeutic targets, prediction of drug-tumor interaction mechanisms, and modeling of patient-specific responses to treatment. These systems can significantly shorten timeframes for drug research and development and can ultimately improve the success of oncology pipelines. In addition, pharma companies are also using AI solutions for patient-trial identification, trials that involve the identification of biomarkers, and trial submissions that leverage real-world data.

By Deployment Mode:

The cloud deployment segment holds the largest share of the market and will experience the highest growth rate due to increasing demand for scalable, cost-effective, interoperable infrastructure for artificial intelligence. Access to cloud resources provides on-demand access to powerful computing to analyze medical images, genomic data sets, and predictive models. The healthcare system finds the cloud attractive due to flexibility, rapid implementation, and the ability to leverage remote diagnostics and collaborative research across locations. Furthermore, cloud artificial intelligence drastically reduces initial expenditures on IT while supporting continuous updates and cybersecurity improvements.

The on-premises segment will experience sales growth at a steady pace, as some healthcare organizations prefer greater high-level data management, rigorous security, and facilitation for regulatory compliance. Many cancer centers and government funded hospitals continue to prefer on-premises infrastructure to retain control over sensitive information regarding images and genetic data. Furthermore, using on-premises artificial intelligence systems may provide for more improved customization options for an organization to adapt the software performance to their diagnostics and therapies. While the adoption of the cloud will become standard practice, there will be other facilities, particularly those processing ultra-sensitive patient data, that will prefer to keep everything managed on-site.

Browse More Insights of Towards Healthcare:

The global oncology drugs market size is estimated at US$ 204.39 billion in 2024, is projected to grow to US$ 217.18 billion in 2025, and is expected to reach around US$ 360.79 billion by 2034. The market is projected to expand at a CAGR of 6.29% between 2025 and 2034.

The global oncology API market size is calculated at USD 41.79 billion in 2024, grew to USD 43.95 billion in 2025, and is projected to reach around USD 69.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

The global oncology biomarker market size is calculated at US$ 34.16 billion in 2024, grew to US$ 38.62 billion in 2025, and is projected to reach around US$ 113.54 billion by 2034. The market is expanding at a CAGR of 12.73% between 2025 and 2034.

The global oncology devices market size is calculated at US$ 150.35 billion in 2024, grew to US$ 177.17 billion in 2025, and is projected to reach around US$ 776.3 billion by 2034. The market is expanding at a CAGR of 17.84% between 2025 and 2034.

The oncology drug discovery market is poised for significant expansion from 2024 to 2034, driven by rapid advancements in precision medicine, AI-enabled drug development, and a growing pipeline of targeted therapies.

The global oncology automation market size is calculated at US$ 2.82 billion in 2024, grew to US$ 3.12 billion in 2025, and is projected to reach around US$ 7.77 billion by 2034. The market is expanding at a CAGR of 10.68% between 2025 and 2034.

The global oncology NGS market size was calculated at US$ 508.95 million in 2024, grew to US$ 589.01 million in 2025, and is projected to reach around US$ 2,193.49 million by 2034. The market is expanding at a CAGR of 15.73% between 2024 and 2034.

The global oncology clinical trial market size recorded US$ 13.64 billion in 2024, set to grow to US$ 14.36 billion in 2025 and projected to hit nearly US$ 22.85 billion by 2034, with a CAGR of 5.30% throughout the forecast timeline.

The global oncology molecular diagnostics market size is calculated at USD 3.11 billion in 2024, grew to USD 3.48 billion in 2025, and is projected to reach around USD 9.76 billion by 2034. The market is expanding at a CAGR of 12.13% between 2025 and 2034.

The global oncology companion diagnostic market size is calculated at USD 5.24 in 2024, grew to USD 5.7 billion in 2025, and is projected to reach around USD 12.07 billion by 2034. The market is expanding at a CAGR of 8.73% between 2025 and 2034.

Recent Developments:

In May 2025, Predictive Oncology Inc. announced an expansion of its AI-driven platform to include both biomarker discovery and drug repurposing, leveraging its large live-cell tumor biobank to accelerate precision oncology innovation.

AI In Oncology Market Key Players List:

- Siemens Healthineers

- GE Healthcare

- Medtronic

- IBM Watson Health

- NVIDIA Corporation

- Philips Healthcare

- Flatiron Health

- PathAI

- Azra AI

- ConcertAI

- Digital Diagnostics

- Median Technologies

- Radformation / Limbus AI

- DeepMind Health

- Intel Corporation

- Canon Medical Systems

- Oncora Medical

- Paige AI

- Imagia Cybernetics

Segments Covered in the Report

By Component

- Software Solutions

- Hardware

- Services

By Application

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Brain Tumors

- Others

By End-User

- Hospitals

- Pharmaceutical Companies

- Research Institutes

- Others

By Deployment Mode

- Cloud-Based

- On-Premises

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6328

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest